.jpg?width=2254&height=2254&name=Max%20(Upclose).jpg)

The SMART Path to Resilient Self-Storage Investments

At Modular Storage Solutions, we believe the smartest path to reliable real estate returns begins by directly addressing market inefficiencies—particularly the underserved demand for quality self-storage in Canada's secondary and tertiary markets.

By marrying our Equity-First Financing model with modular technology through our signature Smart Storage Platform, we've crafted an investment approach that's lean on risk and high on opportunity.

Welcome to The SMART Path.

S — Strategic Diversification

Why It Matters: Traditional multifamily investments have become overcrowded and overleveraged, relying heavily on ideal economic conditions. Self-storage offers investors a stable, resilient alternative with proven performance through economic shifts.

How We Deliver:

- Target Underserved Markets: Strategically investing where growing demand significantly outpaces supply.

- Accelerated Lease-Up: Facilities are positioned through detailed feasibility analyses for rapid occupancy and consistent cash flow.

Investor Benefit: Diversify your portfolio with development-stage equity in an inflation and recession resistant asset class, reducing exposure to volatile, oversaturated markets.

M — Mitigated Risk

Why It Matters: Early-stage real estate projects often depend heavily on costly construction debt, increasing uncertainty and capital risk before generating revenue.

Core Strategies:

- Equity-First Financing: Land acquisition and initial construction phases are entirely equity-funded, eliminating pre-revenue debt.

- Fixed-Cost Contracts: Over 80% of build costs are secured upfront, drastically reducing budget risks.

- Phased Development: Expansion is incremental and leveraged conservatively only after revenue streams stabilize, ensuring predictable growth.

Investor Benefit: Invest confidently with a structure explicitly designed to safeguard your capital from day one—without surprise capital calls or hidden risks.

A — Access to High-Growth Markets

Why It Matters: Large institutional developers primarily target metropolitan areas, leaving substantial demand unaddressed in Canada's mid-sized markets.

Our Advantage:

- Comprehensive Market Analysis: Detailed feasibility studies quantify unmet storage demand.

- Collaborative Site Acquisition: Leveraging extensive real estate networks to secure strategically located on- and off-market properties at attractive valuations.

Investor Benefit: Gain early-mover advantages in markets with pent-up demand, capturing strong returns before institutional competition arrives.

R — Rapid Results

Why It Matters: Traditional self-storage developments often take years to complete, exposing investors to prolonged market risks and delays in revenue.

How We Do It:

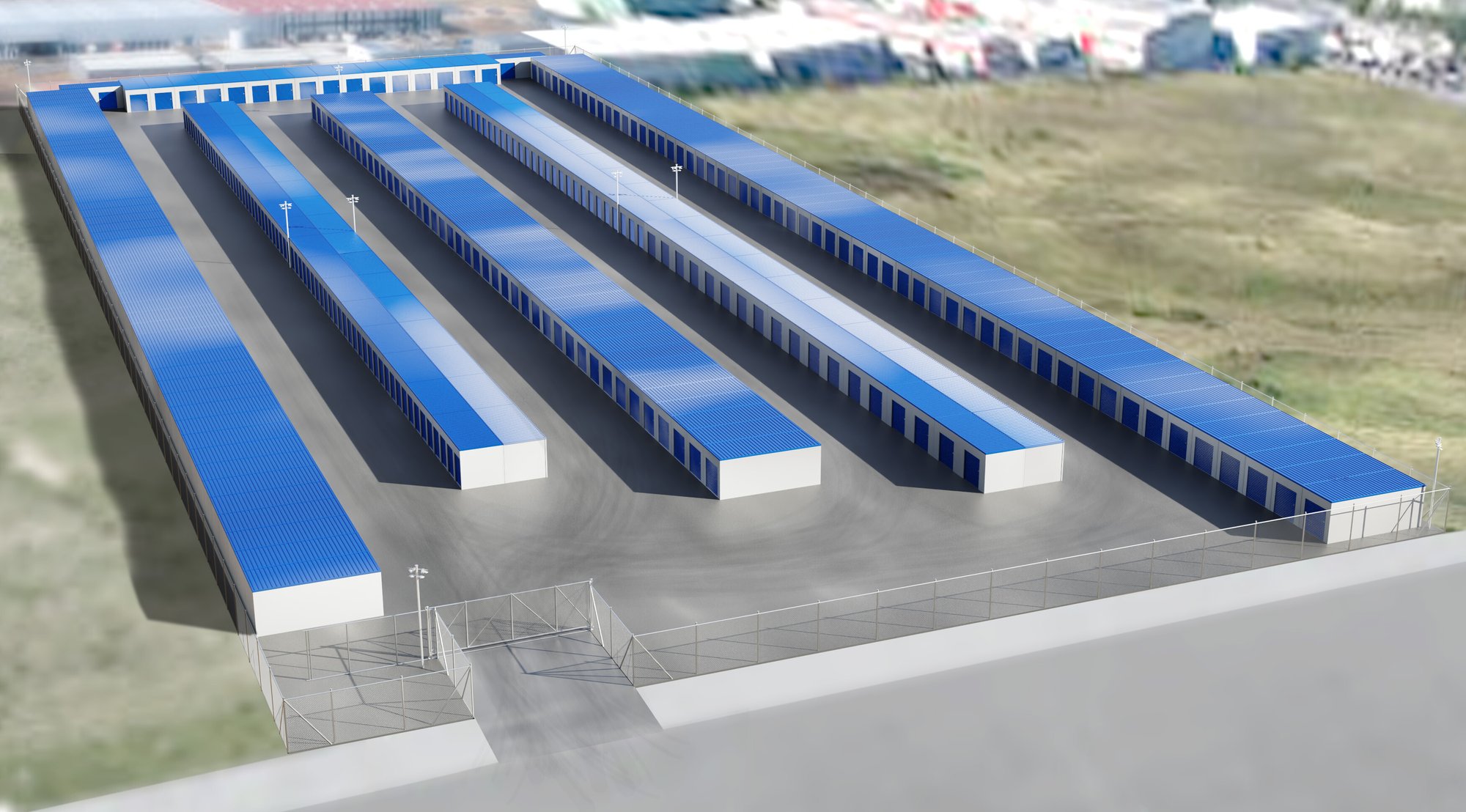

- Modular Construction: Prefabricated, ready-to-assemble storage units shorten project timelines to just 3–6 months.

- Smart Automation: Facilities are managed remotely through AI-enhanced security, app-driven smart entry systems, and centralized support—minimizing overhead and maximizing profitability.

Investor Benefit: Experience quicker market entry, accelerated time to cash flow, and significantly reduced construction and timing risks compared to traditional projects.

T — Trusted Expertise

Why It Matters: Your investment's success depends directly on the depth of expertise and capability of the team managing it. Our specialized knowledge ensures consistent growth, strategic execution, and transparent investor communication.

.jpg?width=2254&height=2254&name=Max%20(Upclose).jpg)

Aaron Rook (RNR)

Erin McCoy (RNR)

Jeremy Woensdregt

MSS Strategic Advisors

Strategic Advisors: Our advisory board comprises seasoned professionals with extensive experience in self-storage development, land acquisition, engineering, project feasibility, and strategic market positioning, enhancing our capacity to deliver reliable investment outcomes.

Reade DeCurtins

David Donogh

Justin Konikow

Investor Benefits

For personalized insights into upcoming equity investment opportunities:

Ready to Follow the SMART Path?

For accredited investors seeking stable real estate returns without the volatility of traditional developments, Modular Storage Solutions provides a uniquely positioned opportunity to:

Strategically Diversify into resilient self-storage.

Mitigate risk with equity-first financing, fixed-cost contracts and phased, controlled growth.

Access high-demand markets before institutional investors.

Rapidly achieve results through modular construction and smart automation.

"Our approach is designed to protect and grow investor capital at every stage, positioning you to fully benefit from Canada's rising self-storage demand—without the uncertainties of traditional real estate projects."

– Max Picton, Founder & CEO

Take the Next Step

Curious about aligning your investment goals with the SMART Path?